In 2023, Canadian homeowners faced challenges with rising interest rates, but many stood strong. Now, there’s hope for relief in 2024. The Bank of Canada raised rates, and more hikes are coming. Some mortgage holders already paid more, but the real test is ahead with $251 billion in mortgages up for renewal in 2024.

Good news: interest rates might drop, easing the payment pinch. The Bank of Canada predicts 8 in 10 might face higher payments by 2025, but relief is in sight.

On the housing front, experts predict a rebound in 2024. The Canadian Real Estate Association expects a 9% jump in home sales and a 1.5% rise in the average home price to $690,916.

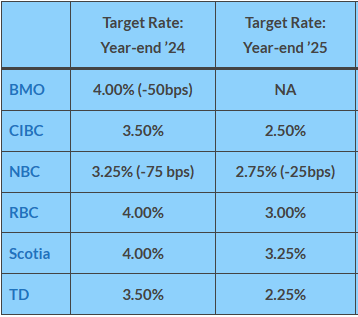

Forecasts from most of the Big 6 banks see the overnight target rate falling back to at least 4.00% by the end of 2024 from its current rate of 5.00%.

The following are the latest interest rate forecasts from the Big 6 banks: